As I’ve mentioned before, I’m a total personal finance geek.

How does one become a PF geek, you ask? The simple answer is: debt.

I have a list of blogs that I read (check the blog roll!)

and among them are a few of the top PF bloggers in Canada wanted want my bank balance

to be in the black forever. I’ve soaked

up their techniques and knowledge, and tweaked their advice to suit my own

lifestyle and preference for managing my spending.

Here’s a little breakdown of how I’ve made it work:

Comparatively speaking, I know I’m not deep in debt. I started out with just over $13,000 and have

a little left to pay off (more on that later in this post). But it’s made me obsessed with watching my

bank balance, noting all of my spending and making every penny count. Not bad traits, I’d say. I’ve tried not to cheap out where it counts,

like for gifts and when I truly need a fun night with the girls after a long

week at work, and I think I’ve done a good job overall of curbing my spending

and paying down that debt vigorously.

Here I am, less than 2 years after graduating (yes, a hint

at my age!) and I’ve only got $ $2,975.78 left to pay.

I’d say that’s pretty damned good. Considering the only debt I’ll have left is my

mortgage (there was no getting around that one, unfortunately) and have some

savings in the bank for a trip and for any potential emergencies, I’m going to

be in great shape really soon.

I’ve cut coupons, taken {almost} anything that’s free, and

live on less than $400 per month. Yes,

that’s right: I live on a mere percentage of my monthly income. Why? So

the rest can go to savings, and debt repayment. Once that debt is clear, I’ll never have to

worry about that again, and all that extra left at the end of the month can simply

go into various accounts. I think I will

set them up as follows:

- Mortgage (lump sum, yearly pay-off)

- Property tax (should be less than $1,500 per year, so I can get this beefed up in no time)

- Fun

- Emergencies

Those four categories should suffice, for now at least. I’m thinking of setting up an RRSP as well…but

since I have a pension with work, I’m debating about waiting until I move to a

higher tax bracket and really need the cut in taxable income. That’s something that could be added as a 5th

account, or I’ll wait it out. I’m sure

there will be more on that later.

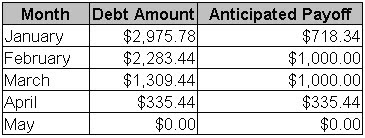

Based on my calculations below, I will be completely debt

free in April. Holy eff! I didn’t anticipate that being so soon, but I’m

not gonna complain. The chart below

assumes $26 per month in interest {should be less, but let’s err on the side of

caution}, and $1,000 per month payoff, except for this month due to covering my

puppy’s vet expenses and the leftovers from my holiday spending:

I’m going to use this as my inspiration to keep me on track

and to be 100% consumer debt free less than 2 years after my university grad. Happy 2010 to me. This is gonna be a great year. I can feel it in ma bones!!!!!

Hugs,

*Canadian Girl

No comments:

Post a Comment